Liquidation of LLP

Liquidation of a Limited Liability Partnership (LLP) in Kazakhstan: Rules and Key Aspects

While the process of opening a company in Kazakhstan is usually straightforward, when it comes to closing or liquidating a company, the process becomes more complex and time-consuming. The most popular organizational and legal form for entrepreneurs in Kazakhstan is the Limited Liability Company (LLP). When establishing an LLP, few consider the risks that await the company if it becomes inactive. Many mistakenly believe that if an LLP simply exists and does not operate, there is no need to submit reports, pay taxes, and so on. However, this is not the case. Any company is obligated to regularly submit tax and statistical reports, pay taxes at least for the director of the company, even if no business activities are being conducted, maintain a legal address, and more. Failure to comply with such rules can lead to fines and other penalties. To avoid such risks, there is a liquidation procedure. If a company remains inactive for an extended period and its operations are not planned to be resumed, it is better to liquidate it.

Liquidation of an LLP is the process that arises from the decision to permanently terminate the company’s activities. In Kazakhstan, the legislation provides certain procedures and requirements for carrying out the liquidation of an LLP. In this article, we will explore the main aspects of this process and provide useful advice for a successful liquidation of an LLP in Kazakhstan.

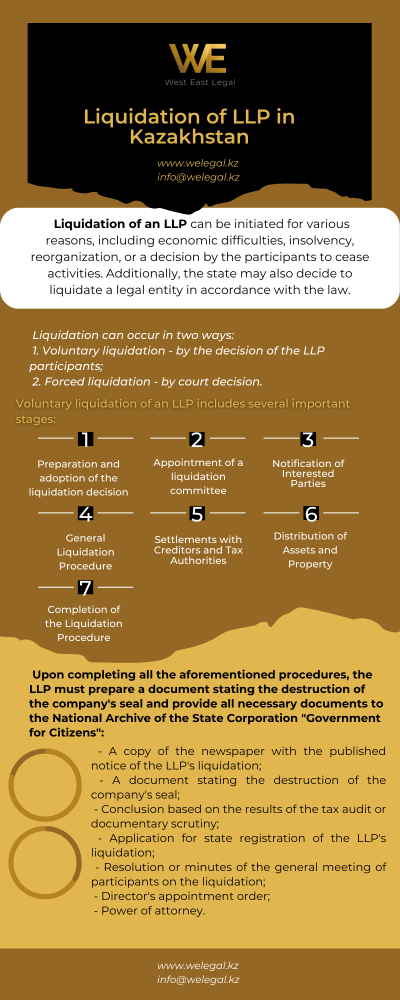

Causes of LLP liquidation: Liquidation of an LLP can be initiated for various reasons, including economic difficulties, insolvency, reorganization, or a decision by the participants to cease activities. Additionally, the state may also decide to liquidate a legal entity in accordance with the law.

Liquidation can occur in two ways:

- Voluntary liquidation – by the decision of the LLP participants;

- Forced liquidation – by court decision.

Next, we will examine the procedure for voluntary liquidation of an LLP in more detail. Voluntary liquidation of an LLP includes several important stages:

- Preparation and adoption of the liquidation decision:

Before commencing the liquidation procedure of the LLP, internal negotiations with the founders are necessary to decide on the termination of the company’s activities. The liquidation decision must be officially recorded and approved by the LLP participants in the form of minutes of the general meeting of participants (if there are 2 or more participants) or in the form of a decision of the sole participant (if there is only one participant).

- Appointment of a liquidation committee:

One of the first steps in the liquidation process is the appointment of a liquidation committee. The liquidation committee should consist of representatives of the LLP who will oversee and coordinate the entire liquidation process. Typically, the liquidation committee consists of a minimum of two individuals (usually the director and accountant of the LLP), and it may also include other employees of the LLP, such as the company’s lawyer. The chairman of the committee, as well as its composition and powers, are approved at the general meeting of participants and documented in the minutes (if there are 2 or more participants) or the decision of the sole participant (if there is only one participant).

- Notification of Interested Parties:

The LLP is required to notify all interested parties of its intention to liquidate the company. This includes employees, creditors, partners, and government authorities. The notification must be provided in written form and include all necessary details and deadlines for the liquidation.

The notifications are classified as follows:

- Notice of dismissal to employees at least 1 month in advance (Article 52 of the Labor Code of Kazakhstan).

Impact on employees: During the liquidation of the LLP, special attention must be given to matters concerning employees. Kazakhstan’s legislation imposes obligations on employers to pay wages, provide leaves, and other social guarantees to dismissed employees. The rights and interests of employees must be protected during the liquidation process.

- Notification to the Ministry of Justice of Kazakhstan or the State Corporation “Government for Citizens” in writing or through electronic services using an electronic digital signature (within the shortest time possible) (Paragraph 1 of Article 50 of the Civil Code of Kazakhstan);

- Notification to the Tax Authorities at the place of LLP registration within 3 working days from the date of the decision (Paragraph 1 of Article 58 of the Tax Code of Kazakhstan);

- Notification to the Employment Center about an increase in the number of unemployed individuals at least 1 month before their dismissal (Subparagraph 2 of Paragraph 2 of Article 103 of the Social Code of Kazakhstan);

- Public notification of the company’s liquidation by publishing an announcement in newspapers of national significance, indicating the deadlines for creditors to submit claims, not less than 2 months from the date of publication (Paragraph 3 of Article 50 of the Civil Code of Kazakhstan).

- General Liquidation Procedure:

After 2 months from the date of publication of the announcement in the newspaper, it is necessary to prepare an intermediate liquidation balance and prepare the liquidation tax reporting. Then, a request for a tax audit and tax reporting with the note “liquidation” must be submitted to the Tax Authorities at the place of LLP registration, along with the aforementioned documents (within 3 days from the date of approving the intermediate liquidation balance).

Additionally, all the LLP’s bank accounts should be closed, and statements on account closure should be provided to the Tax Authorities at the place of LLP registration. If the LLP has a cash register machine (CRM), it should also be deregistered.

In addition to the above-mentioned documents, an order appointing the director of the LLP, a copy of the director’s identity document, the resolution (minutes), and the notification of the LLP’s liquidation, as well as a power of attorney, if a third party within the liquidation committee is handling the liquidation, must be attached.

The tax audit by the Tax Authorities at the place of LLP registration should be completed within 20 working days from the date of receiving the application (the audit may take around 2 months). Upon completion of the tax audit, the Tax Authorities will issue a conclusion based on the results of the tax audit.

After passing the tax audit, the final version of the liquidation balance must be prepared.

Simplified Liquidation Procedure:

The simplified liquidation procedure applies to an LLP that simultaneously meets the following criteria:

- Not registered for VAT;

- Not engaged in separate types of activities;

- Not applying special regimes for agricultural producers;

- Has not been previously reorganized;

- Not included in the plan for tax audits.

The essence of the simplified procedure is that the LLP bypasses a tax audit and only undergoes documentary scrutiny at the Tax Authorities at the place of registration.

The LLP must also provide the Tax Authorities at the place of registration with a liquidation balance, close all its bank accounts, deregister the cash register machine (CRM), and submit the director’s appointment order, a copy of the director’s identity document, the resolution (minutes), the notification of the LLP’s liquidation, and a power of attorney if a third party within the liquidation committee is handling the liquidation.

Timeframes for documentary scrutiny:

Within 3 working days from the date of receiving the application, the Tax Authorities at the place of registration request information about the LLP from banks, customs authorities, and funds. The information is provided within 20 working days. Subsequently, within 10 working days, the Tax Authorities conduct the documentary scrutiny.

After completing the documentary scrutiny and in the absence of any violations, the Tax Authorities issue a conclusion.

If there are violations, the LLP receives a notice to rectify the identified violations, which must be addressed within 5 working days. Failure to rectify them initiates a standard tax audit.

- Settlements with Creditors and Tax Authorities:

The liquidation committee must analyze all property obligations of the LLP and settle them with creditors. Additionally, all necessary documentation confirming the fulfillment of tax obligations must be provided to the tax authorities. In case of any debts to creditors or tax authorities, all required settlements and payments must be made.

- Distribution of Assets and Property:

After settling obligations with creditors and tax authorities, the liquidation committee must determine the order of distributing the assets and property of the LLP. If there is remaining property after settling financial obligations, it should be distributed among the participants or other interested parties in proportion to their capital participation.

- Completion of the Liquidation Procedure:

Upon completing all the aforementioned procedures, the LLP must prepare a document stating the destruction of the company’s seal and provide all necessary documents to the National Archive of the State Corporation “Government for Citizens”:

– A copy of the newspaper with the published notice of the LLP’s liquidation;

– A document stating the destruction of the company’s seal;

– Conclusion based on the results of the tax audit or documentary scrutiny;

– Application for state registration of the LLP’s liquidation;

– Resolution or minutes of the general meeting of participants on the liquidation;

– Director’s appointment order;

– Power of attorney.

Conclusion:

The liquidation procedure of an LLP in Kazakhstan requires adherence to specific rules and procedures, as well as careful organization. Properly conducting the liquidation will help avoid legal issues and simplify the company’s closure. It is essential to seek advice from specialists or legal firms specializing in company liquidation to ensure all steps in the LLP liquidation process in Kazakhstan are executed correctly. The legal firm “WE Legal” will be glad to assist you in preparing all the necessary documents and accompany you and your company during the initiation of the liquidation procedure.