Doing Business in Kazakhstan

Doing Business in Kazakhstan.

Let’s consider the most popular ones:

Establish a Limited Liability Partnership (LLP).

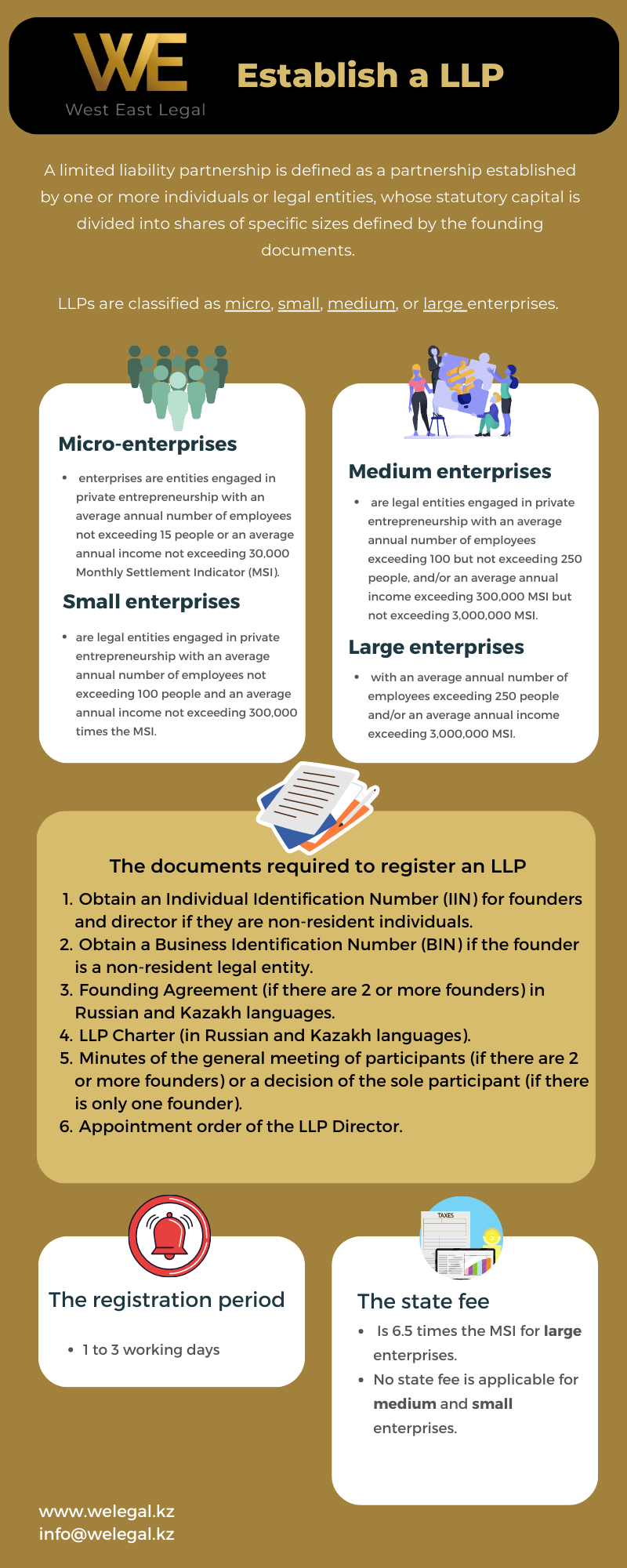

According to the Law of the Republic of Kazakhstan dated April 22, 1998, No. 220-I “On Limited and Additional Liability Partnerships,” a limited liability partnership is defined as a partnership established by one or more individuals or legal entities, whose statutory capital is divided into shares of specific sizes defined by the founding documents. Participants of the limited liability partnership are not liable for its obligations and bear the risk of losses associated with the partnership’s activities within the value of their contributions.

It follows that founders of an LLP can be one or more individuals and/or legal entities (registered in Kazakhstan or foreign). However, an LLP cannot have another Kazakhstani economic partnership consisting of a sole participant as its sole participant.

LLPs are classified as micro, small, medium, or large enterprises. According to the Entrepreneurial Code of the Republic of Kazakhstan, micro-enterprises are entities engaged in private entrepreneurship with an average annual number of employees not exceeding 15 people or an average annual income not exceeding 30,000 Monthly Settlement Indicator (MSI).

Small enterprises are legal entities engaged in private entrepreneurship with an average annual number of employees not exceeding 100 people and an average annual income not exceeding 300,000 times the MSI. Small enterprises cannot engage in certain types of activities, including:

1) Activities related to the circulation of narcotic drugs, psychotropic substances, and precursors;

2) Production and/or wholesale of excisable goods;

3) Grain storage activities at grain receiving points;

4) Lottery operations;

5) Gambling business activities;

6) Activities related to the circulation of radioactive materials;

7) Banking activities (or certain types of banking operations) and activities in the insurance market (except for insurance agent activities);

8) Audit activities;

9) Professional activities in the securities market;

10) Credit bureau activities;

11) Security activities;

12) Activities related to the circulation of civilian and service weapons and ammunition.

Medium enterprises are legal entities engaged in private entrepreneurship with an average annual number of employees exceeding 100 but not exceeding 250 people, and/or an average annual income exceeding 300,000 MSI but not exceeding 3,000,000 MSI.

Large enterprises are legal entities engaged in private entrepreneurship with an average annual number of employees exceeding 250 people and/or an average annual income exceeding 3,000,000 MSI.

The minimum amount of statutory capital is as follows: 100 MSI for medium and large enterprises; from 0 tenge to 100 MSI for small enterprises.

The documents required to register an LLP are as follows:

- Obtain an Individual Identification Number (IIN) for founders and director if they are non-resident individuals.

- Obtain a Business Identification Number (BIN) if the founder is a non-resident legal entity.

- Founding Agreement (if there are 2 or more founders) in Russian and Kazakh languages.

- LLP Charter (in Russian and Kazakh languages).

- Minutes of the general meeting of participants (if there are 2 or more founders) or a decision of the sole participant (if there is only one founder).

- Appointment order of the LLP Director.

The registration period for an LLP is from 1 to 3 working days.

The state fee is 6.5 times the MSI for large enterprises. No state fee is applicable for medium and small enterprises.

→ More info how to establish a LLP

Branch or Representative Office of your company in the territory of the Republic of Kazakhstan.

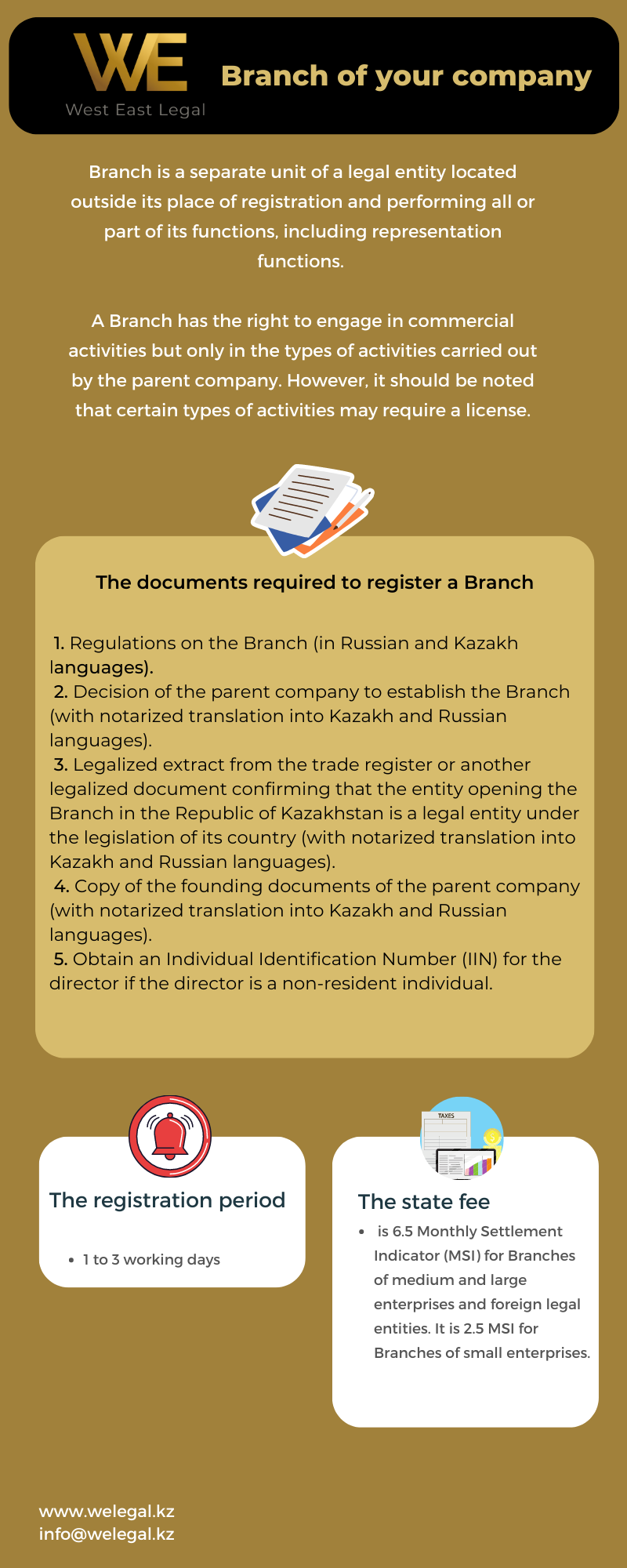

According to the Civil Code of the Republic of Kazakhstan, a Branch is a separate unit of a legal entity located outside its place of registration and performing all or part of its functions, including representation functions. A Branch has the right to engage in commercial activities but only in the types of activities carried out by the parent company. However, it should be noted that certain types of activities may require a license.

The documents required to register a Branch are as follows:

- Regulations on the Branch (in Russian and Kazakh languages).

- Decision of the parent company to establish the Branch (with notarized translation into Kazakh and Russian languages).

- Legalized extract from the trade register or another legalized document confirming that the entity opening the Branch in the Republic of Kazakhstan is a legal entity under the legislation of its country (with notarized translation into Kazakh and Russian languages).

- Copy of the founding documents of the parent company (with notarized translation into Kazakh and Russian languages).

- Obtain an Individual Identification Number (IIN) for the director if the director is a non-resident individual.

The registration period for a Branch is from 1 to 3 working days.

The state fee is 6.5 Monthly Settlement Indicator (MSI) for Branches of medium and large enterprises and foreign legal entities. It is 2.5 MSI for Branches of small enterprises.

A Representative Office

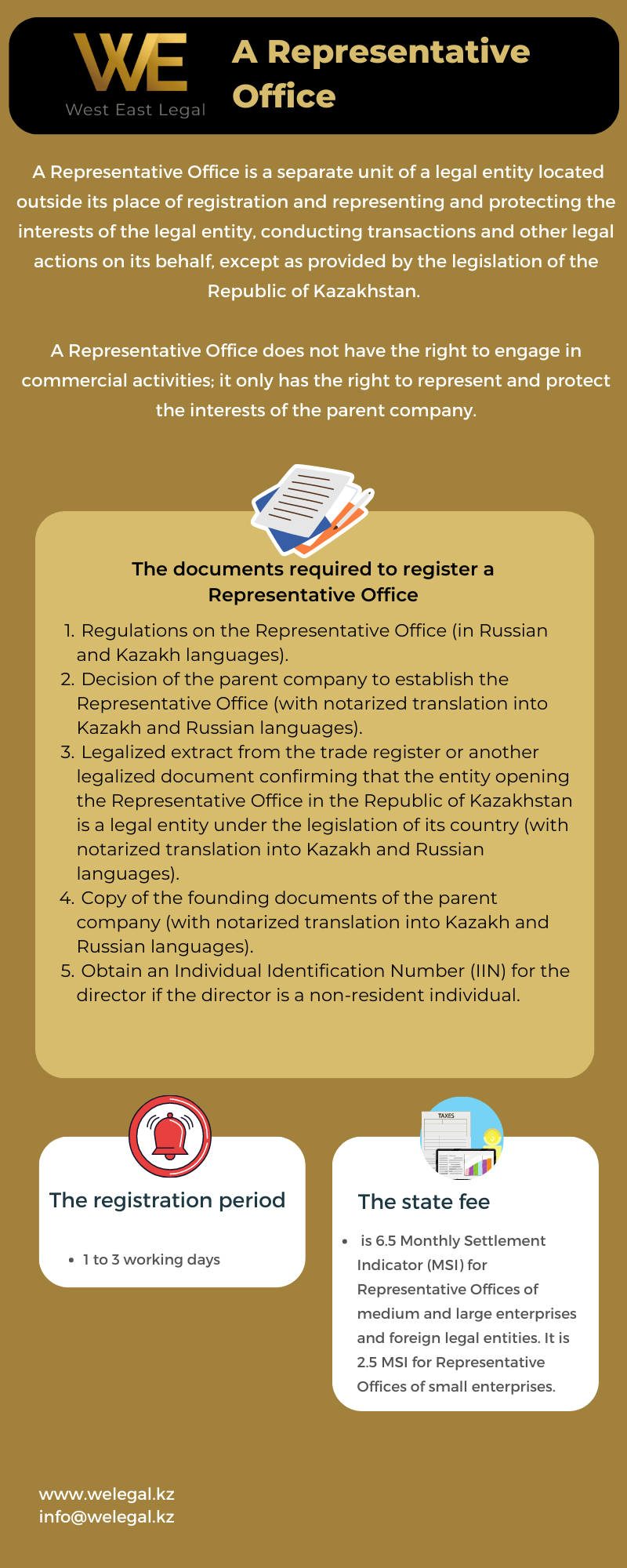

A Representative Office is a separate unit of a legal entity located outside its place of registration and representing and protecting the interests of the legal entity, conducting transactions and other legal actions on its behalf, except as provided by the legislation of the Republic of Kazakhstan. A Representative Office does not have the right to engage in commercial activities; it only has the right to represent and protect the interests of the parent company.

The documents required to register a Representative Office are as follows:

- Regulations on the Representative Office (in Russian and Kazakh languages).

- Decision of the parent company to establish the Representative Office (with notarized translation into Kazakh and Russian languages).

- Legalized extract from the trade register or another legalized document confirming that the entity opening the Representative Office in the Republic of Kazakhstan is a legal entity under the legislation of its country (with notarized translation into Kazakh and Russian languages).

- Copy of the founding documents of the parent company (with notarized translation into Kazakh and Russian languages).

- Obtain an Individual Identification Number (IIN) for the director if the director is a non-resident individual.

The registration period for a Representative Office is from 1 to 3 working days.

The state fee is 6.5 Monthly Settlement Indicator (MSI) for Representative Offices of medium and large enterprises and foreign legal entities. It is 2.5 MSI for Representative Offices of small enterprises.

NOTE: Branches and Representative Offices are not legal entities. They are endowed with assets by the legal entity that established them and operate based on approved regulations. The parent company can be the founder in both cases.

Astana International Financial Centre (AIFC).

The AIFC is a center created for business development and investment attraction. The AIFC operates under a special legal regime in the financial sector. The AIFC is governed by the Constitutional Law of the Republic of Kazakhstan “On the Astana International Financial Centre” dated December 7, 2015.

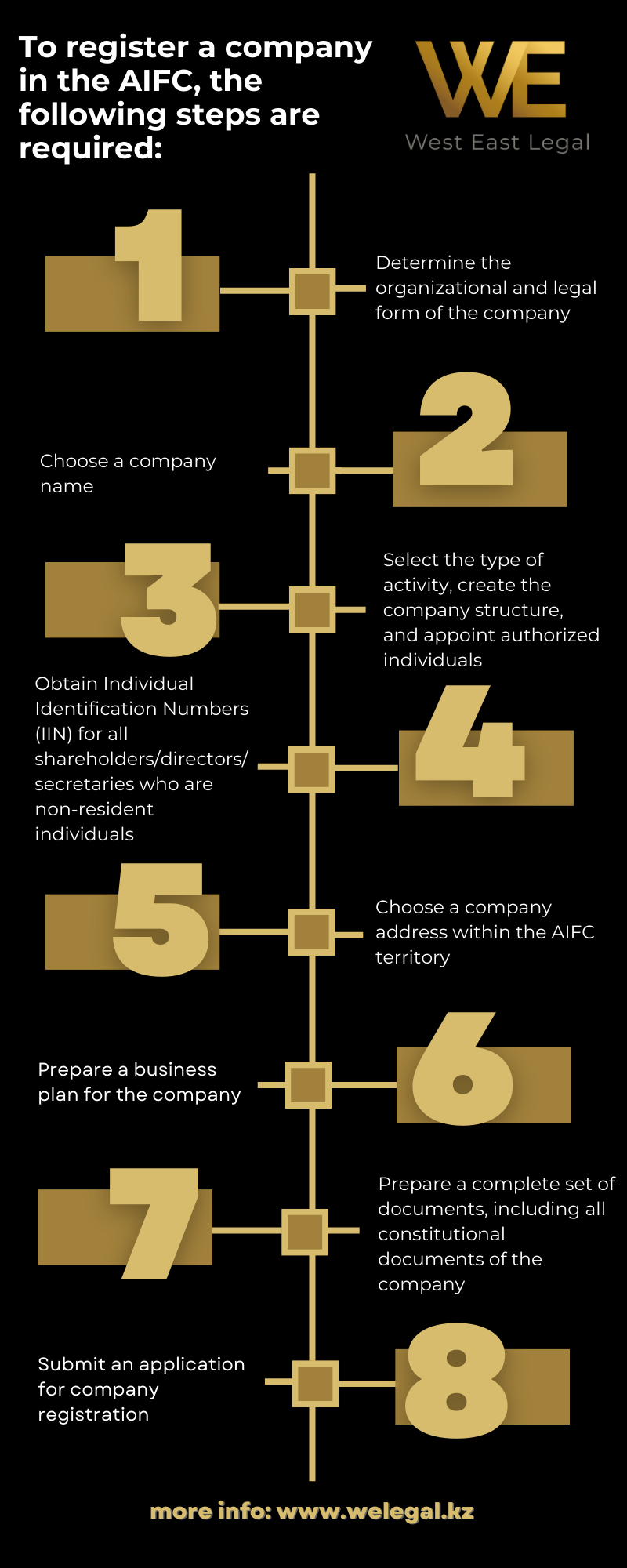

To register a company in the AIFC, the following steps are required:

1) Determine the organizational and legal form of the company. Currently, the AIFC recognizes 15 types of participants:

- Private Company

- Public Company

- Special Purpose Company

- General Partnership

- Limited Partnership

- Limited Liability Partnership

- Non-profit Incorporated Organization

- Recognized Company

- Recognized General Partnership

- Recognized Limited Partnership

- Recognized Limited Liability Partnership

- Investment Companies

- Protected Cell Companies

- Restricted Scope Company

- Foundation

2) Choose a company name. The AIFC has the following requirements for the name:

– The name should not include words that may indicate a connection with the AIFC, the Committee, or any other government body in the AIFC, the city of Astana, or the Republic of Kazakhstan unless the relevant authority has provided written consent to use the name.

– The name should use English alphabet letters, numbers, or other symbols acceptable to the Registrar of Companies.

– The name should not include any of the following words unless the Committee has provided written consent to their use: “bank,” “insurance,” or “trust”; words indicating that the company (or the intended company) is a bank, insurance, or trust company; words that otherwise indicate that the company is authorized to provide financial services in the AIFC.

– The name should not include words that may indicate affiliation or sponsorship with any person or organization unless that person or organization has provided written consent.

– A legal entity should not use a name that, due to any facts, events, or circumstances, may or is likely to mislead, confuse, or conflict with another name (including an existing name of another legal entity or Recognized Company/Partnership).

- Select the type of activity, create the company structure, and appoint authorized individuals (each type of participant has its own requirements regarding the number of shareholders, directors, and secretaries).

Note: Some types of activities require licensing in the AIFC, so it is necessary to check if your activity falls under the licensed category.

- Obtain Individual Identification Numbers (IIN) for all shareholders/directors/secretaries who are non-resident individuals.

- Choose a company address within the AIFC territory.

- Prepare a business plan for the company.

- Prepare a complete set of documents, including all constitutional documents of the company. An indicative list of documents and the required application can be provided by the Registrar, including:

– The only founding document of the company, the Articles of Association, which should contain complete information about the company based on the requirements of the AIFC Acts, which should be attached to the application.

– When completing the application, you will also need to fill in a declaration, a questionnaire with contact details of the applicant, specify the type of activity, fill in the section related to AML/CFT (according to the AIFC rules on Anti-Money Laundering and Countering the Financing of Terrorism), then complete the application for obtaining a Business Identification Number (BIN), provide full information about the shareholder(s), director(s), and secretary of the company, attach the business plan, lease agreement (or other agreement confirming the company’s address within the AIFC territory), decision on the establishment of the company, copies of passports of all shareholders and ultimate beneficiaries, as well as other documents required by the Registrar.

Note: All foreign documents are not apostilled or translated into Russian/Kazakh. All documents should be submitted to the AIFC in English.

- Submit an application for company registration. The registration fee varies from USD 300 to USD 1,000, depending on the chosen organizational and legal form.

Doing business in the AIFC has several advantages. For example, AIFC bodies and participants, as well as their employees, are exempt from tax payments until January 1, 2066, for certain taxes, including corporate income tax, individual income tax, land tax, and property tax. The AIFC also provides simplified labor, visa, and currency regimes.

Administrative and judicial proceedings in the AIFC are conducted in English.

Astana Hub

Astana Hub is the largest international IT startup techno-park in Central Asia. It provides conditions for the free development of Kazakhstani and foreign technology companies.

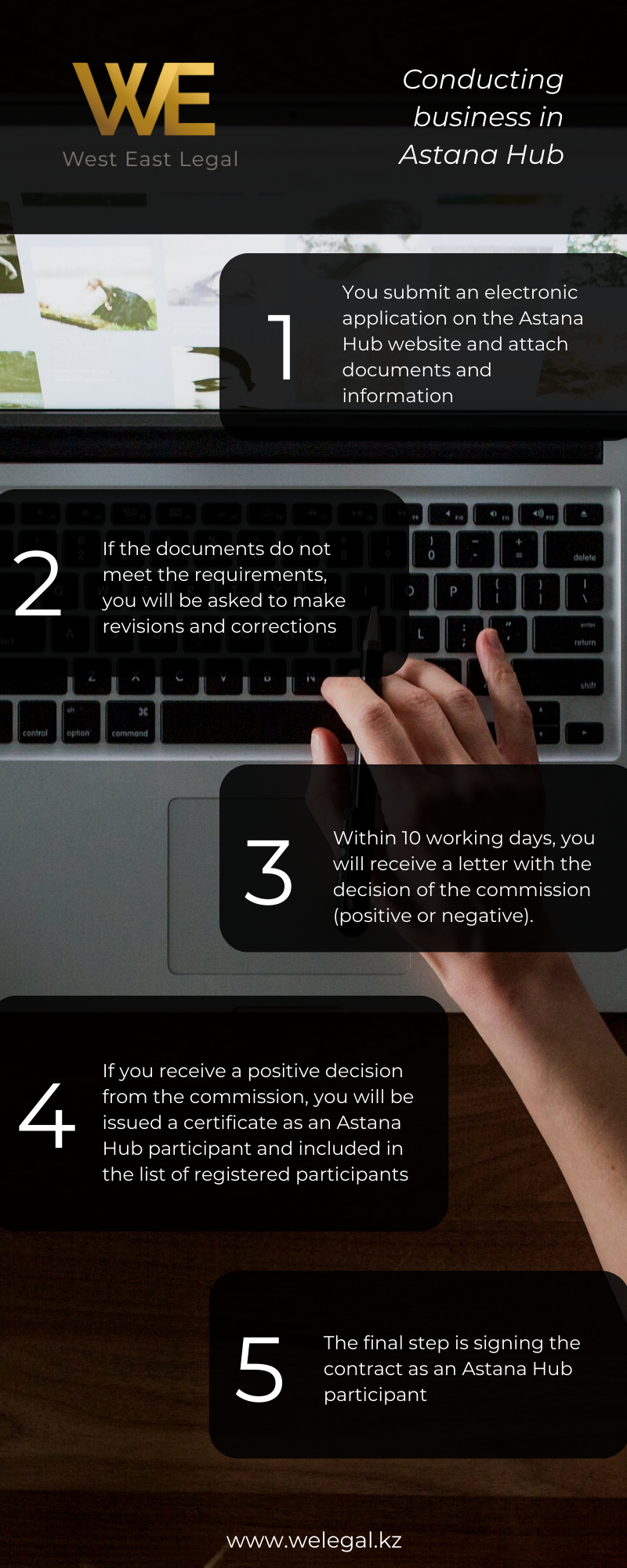

The registration procedure for an IT company is as follows:

- You submit an electronic application on the Astana Hub website and attach the following documents and information (processing the application takes 5 working days):

– Certificate of state registration (re-registration) of the legal entity obtained through the egov.kz portal.

– Copy of the document confirming the authority of the person acting on behalf of the applicant when submitting the application, if such a person is appointed by the applicant (order, decision of the founder, power of attorney).

– Project business plan, prepared in any form, related to priority activities in the field of ICT (requirements for the content of the business plan are specified in the application).

– Certificate of absence of tax arrears, issued no earlier than ten calendar days before the date of application submission (through the egov.kz portal).

– Document confirming the location where the applicant plans to carry out activities (lease agreement or other).

– Information on the number of planned non-residents and residents to be attracted for project implementation (estimated quantity and duration).

- If the documents do not meet the requirements, you will be asked to make revisions and corrections.

- Within 10 working days, you will receive a letter with the decision of the commission (positive or negative).

- If you receive a positive decision from the commission, you will be issued a certificate as an Astana Hub participant and included in the list of registered participants.

- The final step is signing the contract as an Astana Hub participant.

Furthermore, it is worth noting the advantages of Astana Hub:

– Participants of Astana Hub enjoy tax benefits, including exemption from CIT, VAT, PIT, and social tax for non-residents.

– Astana Hub participants can obtain a work visa for up to 5 years.

– Astana Hub participants are exempt from foreign employee quota restrictions.

– Astana Hub participants do not require permission to attract foreign labor.

WE Legal law firm can assist you in opening any type of company in the territory of the Republic of Kazakhstan. They can also prepare all necessary documents and help you start your business.

+77020006316