Kazakhstan imposes “Tax on Google”

Online and E-commerce

As digital resources are growing, a significant part of the sales of goods and services is carried out on the Internet (online) or in E-Commerce. Kazakhstan is closely integrated into the global economy, and the citizens of the country are already accustomed to buying goods or receiving services via the Internet, since there is already a wide selection of goods and services on the market, moreover, a wide choice of quality and prices of these goods and services.

Simultaneously with the advent of E-Commerce, governments have been developing different approaches to the issue of taxation in online transactions for a long time. One of these decisions was the introduction of a certain tax on the amount of a transaction made when purchasing goods and services on the Internet. In the world, this type of tax began to be called “Digital taxes“ or “Tax on Google”. According to information from open sources, today 44 countries have already introduced a digital tax in one form or another, and countries such as Bolivia, China, Colombia, Fiji and Israel are planning to introduce a digital tax shortly (for more details: https://www.quaderno.io/blog/digital-taxes-around-world-know-new-tax-rules).

National legislation of the Republic of Kazakhstan

Returning to the national legislation of the Republic of Kazakhstan, we note that from January 1, 2022, articles 777-780 of the Tax Code of the Republic of Kazakhstan dated December 10, 2020, No. 382-VI (hereinafter referred to as the Tax Code) came into force. These articles regulate the special issues of taxation in relation to foreign companies in the implementation of electronic trade in goods, and the provision of services in the electronic form to individuals.

Article 777 of the Tax Code introduces the concept of an “Internet Platform”, which is an information system allocated on the Internet for organizing electronic trade in goods. Meanwhile, a foreign company is a non-resident legal entity or another form of a foreign business organization without forming a legal entity. Consequently, popular among Kazakhs Alibaba.com, iHerb.com, Amazon.com, Walmart.com, eBay.com, as well as Russian Lamoda.ru, Wildberries.ru or Ozon.ru, can be identified as Internet Platforms of foreign companies.

In addition, the Tax Code provides for a definition of “Services in Electronic Form”, which are services provided to individuals through the telecommunications network and the Internet. In other words, popular streaming companies such as Netflix, HBO Max, Disney Plus, Prime Video, Spotify, Yandex and similar companies are also obliged to pay the digital tax.

Given the popularity of the above companies among Kazakhs and the significant importance of the Kazakh market for foreign companies, we consider it useful to describe in more detail the registration procedure with the state revenue authorities of the Republic of Kazakhstan.

Which foreign companies become VAT payers?

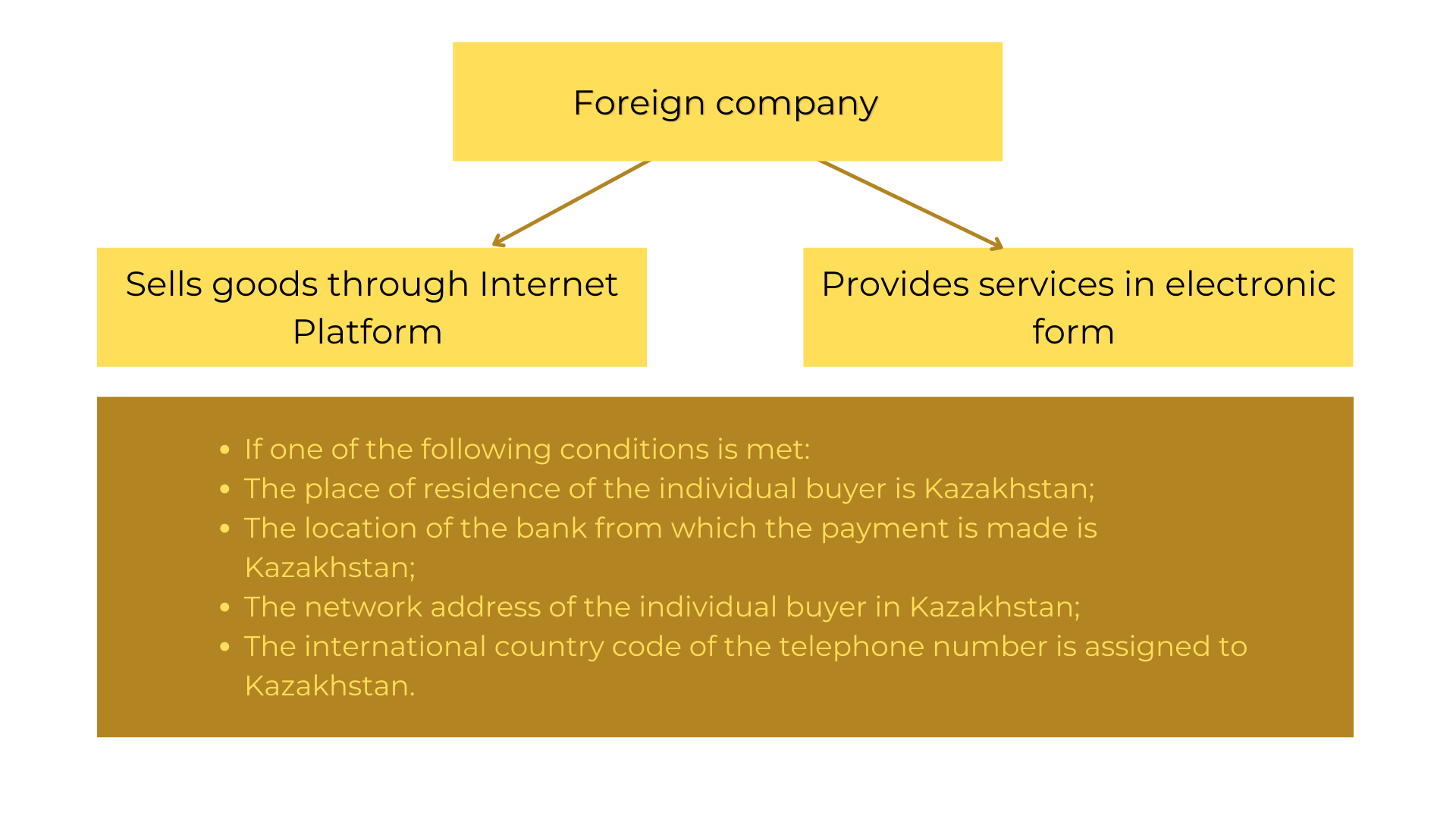

In accordance with the Tax Code, foreign companies engaged in e-commerce must pay a value-added tax or, as previously written, a digital tax at a rate of 12%. To understand whether your company should pay VAT, you can refer to the following chart:

How can foreign companies register as VAT payers?

For conditional registration as a taxpayer, a foreign company sends a confirmation letter by mail on paper to the tax authority indicating:

1) the full name of the foreign company;

2) tax registration number (or its equivalent), if such a number exists in the country of incorporation or the country of residence of the non-resident;

3) state registration number (or it’s equivalent) in the country of incorporation of the non-resident or the country of residence of the non-resident;

4) bank details from which the payment of value-added tax will be made in the course of electronic trade in goods, provision of services in the electronic form to individuals;

5) a list of details, including merchant ID data, used to receive payments and (or) money transfers;

6) postal details (official email address, location address in the country of incorporation or country of residence of a non-resident).

What are the features of VAT payment you need to know?

Issuance of invoices by the payer of value-added tax for goods sold and services rendered to individuals in electronic form is not required.

A foreign company is obliged to pay the calculated value-added tax when carrying out electronic trade in goods, providing services in the electronic form to individuals to the budget, for each quarter no later than the 25th day of the second month following the quarter in which the sale of goods, the provision of services was made.

At the same time, there are the following cases when VAT for e-commerce to individuals is not subject to the calculation:

1) in terms of exceeding the cost and (or) weight norm, determined under the customs legislation of the Eurasian Economic Union and (or) the customs legislation of the Republic of Kazakhstan, for which customs duties and taxes were paid in the Republic of Kazakhstan in the form of a total customs payment and are not refundable;

2) if the cost of such goods, services are included in the number of taxable imports, determined under Article 444 of the Tax Code, according to which the value-added tax on imported goods from the member states of the Eurasian Economic Union is paid to the budget of the Republic of Kazakhstan and is not refundable under chapter 50 of the Tax Code.

Summarizing the above-mentioned, it should be noted that the digital tax is becoming a widespread instrument of state regulation in the world. Kazakhstan is no exception and has also amended the Tax Code, which provides for the obligation of foreign companies that sell goods through an Internet Platform or provide services electronically to individuals in the Republic of Kazakhstan to pay VAT or digital tax at a rate of 12%.

The Tax Code provides for an algorithm for registering as a VAT taxpayer and submitting reports. Considering that this innovation came into force on January 1, 2022, practical experience has just begun to accumulate both from government agencies and foreign companies.

According to Article 780 of the Tax Code, a foreign company is obliged to pay the calculated VAT when carrying out electronic trade in goods, providing services in the electronic form to individuals to the budget, for each quarter no later than the 25th day of the second month following the quarter in which the sale of goods was carried out, the provision of services. In other words, foreign companies must go through the conditional registration procedure and pay VAT by May 25, August 25, November 25 and February 25 for each previous quarter, respectively.

WE Legal can help and guide you through the complex interweaving of the ever-changing tax laws of the Republic of Kazakhstan. We will not only identify existing and potential risks but also help you find the most appropriate solutions for them to develop your business.